It’s been awhile… Thankfully, Lexi only spent a week in the hospital, then another 5 days on oral antibiotics. She was given the all clear last week by the surgeon to resume everything as she feels up to it. Let’s just say I’m ready for 2020 to be over with. Almost losing a kid is not something I want lingering around.

However, the fallout of that emergency is starting to show up. Medical claims are being settled with our insurance, and the bills will start rolling in soon (we’ve already received one).

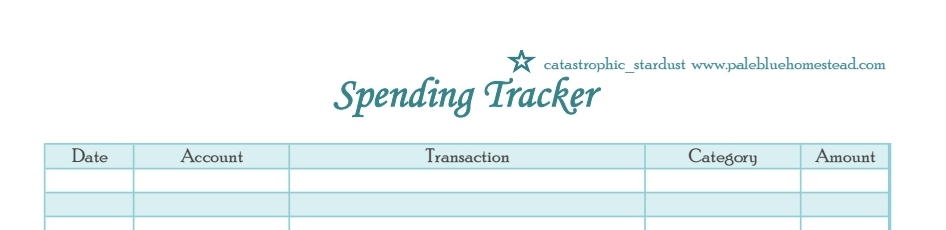

We have always had a rough budget, but I’ll be the first to admit we aren’t great with money, and we’ve made plenty of financial mistakes. Knowing that we are carrying a lot of debt right now, with medical debt coming our way, 2021 is the year I write out the ENTIRE BUDGET.

This upcoming month is a practice month for me, to see if my budget numbers for food, gas, and animals is realistic. I’m also figuring out estimates on all the miscellaneous bills that come up throughout the year like holidays and car registration.

I’ve watched lots of YouTube videos on debt confessions, monthly budgets, and debt snowballs, and I’m considering doing something similar to help hold us accountable in the new year. Finances are something that gets labeled super personal, so no one openly talks about them, and that needs to change!

Our main goal is obviously getting out of debt. Luke would love to build an airplane, and I want us to get to the point where we have that type of play money in our budget. That means I must have sinking funds set up that we are contributing to, so expenses like property taxes and propane fills are accounted for. Those are the types of things that would go on a credit card when they came up, especially all the years we were a one income family. I don’t regret being home with the kids, but in all honesty, most of those early years Luke’s income was not enough to pay the bills, which equals credit card usage. Thankfully his income has grown since then, and the kids are more self sufficient, which means I can work part time.

Our main sinking fund to focus on is propane! We are pretty low in the tank, so a refill will be coming up in December, and we have next to nothing put back for it!

I’m currently fine tuning budget worksheets, gathering debt totals, and putting it all together in Excel. Here’s hoping practicing December’s budget gets our budget finalized for 2021!

Stay safe! ☄🌟