First New Year’s resolution is the same as always… try to blog more. Life always seems so busy that I can’t even type up a paragraph and attach a picture or two. 🤦♀️

We had a good Winter Holiday, but now it’s day 2 of the new year and soon Monday will come and it’ll be back to the grind… with one new addition!

BUDGETING!

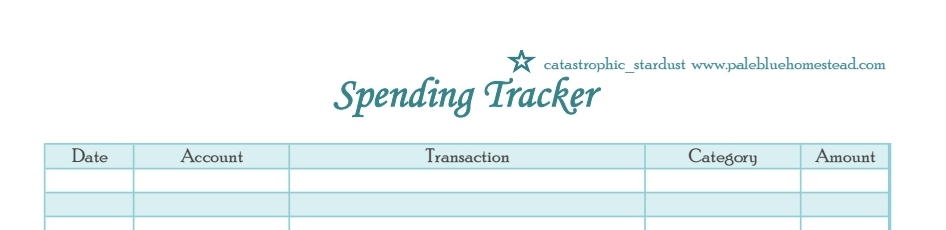

Not just tracking expenses, but preparing for upcoming known expenses, saving for the unexpected that always pops up, and of course, paying off debt without incurring more. I’ve always had a monthly budget, but I never planned for things that I knew were coming. That, along with frivolous spending, equals debt in our case.

So, the biggest budget change (for many Americans) is that the next stimulus check will be arriving soon. Ours is already in the bank!

As you can see, I go right into paying off 2 credit cards in full (yay!), and also paying our propane fill up from December.

Our property taxes are due half in February, and half in July, so that bill will be coming up soon. This is where I’m planning ahead. I now have a sinking fund for property taxes that I hope to add to each month to save for July’s payment, but obviously I didn’t have that last year, so this stimulus was a blessing to get us a leg up, otherwise the February payment would have more than likely went to a credit card.

That leaves $223.91, which will sit in our checking account while I wait for the bill for my new foot orthotics. I’m assuming insurance isn’t touching them, which means they will be $380. 😔

One App I use to track debt payoff is Debt Payoff Planner.

When you pay something off, it congratulates you!

This is what the payoffs look like…

Stay safe! ☄🌟